Watch the video of our May 2022 workshop, or walk through a slide show below.

Definition:

- A conservation easement is a legal document which contains permanent restrictions on the use or development of the land.

The purpose of a conservation easement: To provide a proven tool for land owners who want to personally define and put in place permanent restrictions for:

- The protection of wildlife habitat

- The protection of open space

- The preservation of agricultural lands

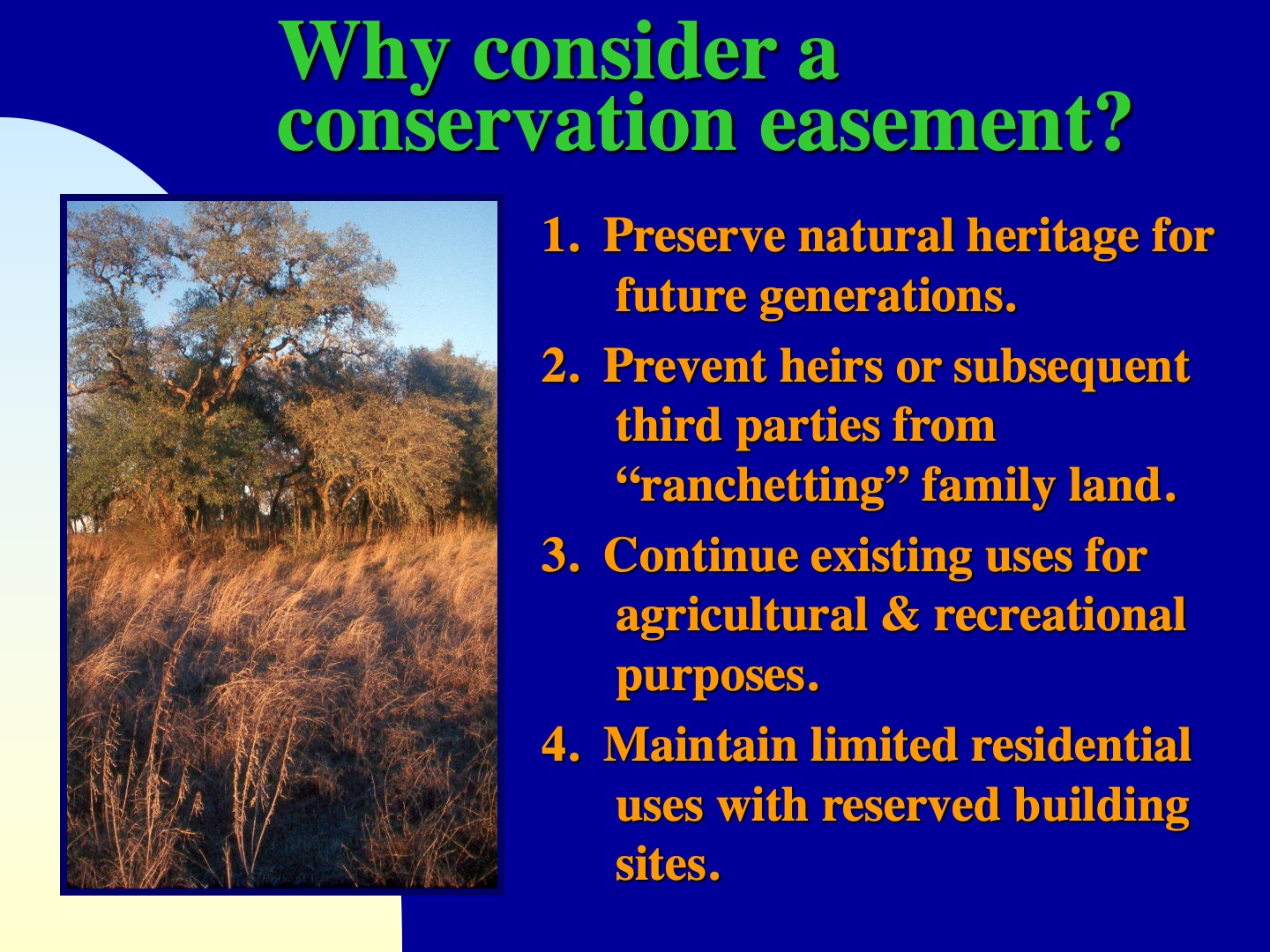

Why consider a conservation easement?

- Preserve natural heritage for future generations

- Prevent heirs or subsequent third parties from “ranchetting” family land

- Continue existing uses for agricultural and recreational purposes

- Maintain limited residential uses with reserved building sites

Tax advantages:

- Income tax benefits

- Estate tax benefits

- Gift tax benefits

How is a conservation easement valued?

- An independent appraiser sets the value by determining the difference in the values of property before and after it would be encumbered by a conservation easement.

Federal Income Tax Benefits:

- Can deduct the value of the easement as a charitable gift, up to 50% of your adjusted gross income each year for 16 years, until the value of the gift is used up. Individuals or corporations can deduct up to 100% of AGI if the majority of that income came from farming, ranching, or forestry.

Estate Tax Benefits:

- The value of the donated easement can be deducted from the taxable value of the estate. An additional 40% of the land’s restricted value can be excluded, up to $500,000, if the easement meets certain conditions under IRC 203(c). After the death of the landowner, the estate may donate an easement and obtain an estate tax deduction for the value of the easement.

Gift Tax Benefits:

- Gifts of property during a property owner’s lifetime can reduce or eliminate gift taxes. Deductible annual gifts are limited, up to a lifetime total of $1,000,000, without incurring gifts taxes. A conservation easement donation made before the gift reduces the value of the property, and the amount of gift tax.

What is a local land trust?

- A local land trust is a private non-profit organization, whose board of directors are members of the community in which the trust operates. The land trust is the recipient of a conservation easement. A land trust has the responsibility of enforcing development restrictions contained in a conservation easement. Representatives of a land trust annually inspect the property. Public access is not required.

Will this prohibit all development?

- No. The landowner can reserve rights to have additional homesites, to use for agricultural purposes, hunting, fishing, or recreation. However, the landowner must sufficiently protect the conservation values.

Ownership Questions:

- Can I sell the property or transfer ownership? YES.

- Will the land trust own the property? NO, the land trust only holds the easement and protects the restrictions you place on the property.

Do land trusts expect an endowment?

- Yes. The land trust is assuming the responsibility for enforcing your legacy in perpetuity. Land trusts need to meet expenses and build a legal defense fund.

What are the first steps?

- Contact family attorney, estate planner, or accountant

- Meet with local land trust

- Survey property

- Environmental assessment

- Draft a plan of restrictions and reserved rights

- Talk with family

Next Steps:

- Letter of intent signed by all property owners and land trust

- Appraisal

- Approval by land trust Board of Directors

- Sign contract

- File at court house